On April 15, 2025, the Canadian Real Estate Association (CREA) released its quarterly forecast for home sales and prices, updating its January outlook to reflect heightened economic and political risks.

For 2025, the CREA now anticipates 482,673 residential transactions, a 0.02% decline from 2024, which is a sharp reversal from the 8.6% growth projected in the first quarter forecast in January. The national average home price is forecast to dip 0.3% to $687,898, roughly $30,000 below earlier estimates. Looking to 2026, sales are expected to rise modestly by 2.9% to 496,487 units, with prices edging up 1.2% to $696,074.

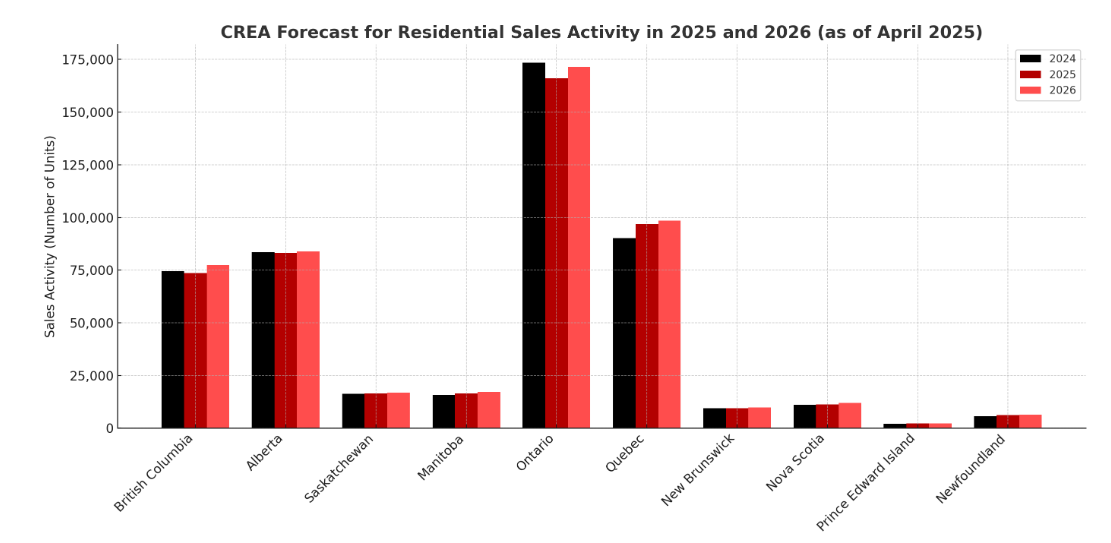

Source: CREA

Source: CREA

Shaun Cathcart, CREA’s Senior Economist, noted that previously, uncertainty about tariffs was contributing to declining home sales, but that going forward, the housing market will need to weather the “actual economic fallout”.

On April 16, the Bank of Canada held its key policy rate at 2.75%, citing unpredictable trade policy and tariff fluctuations as a drag on growth. In its Monetary Policy Report, the Bank outlined a scenario in which a broader trade war could plunge Canada into recession and push inflation above 3% by mid‑2026. The CREA emphasized that all forecasts remain subject to “unprecedented levels of uncertainty,” given unclear interest‑rate trajectories and potential stagflation.