Saskatchewan’s residential market demonstrated a pronounced trend toward tighter conditions over the five-quarter span beginning Q1 2024 and concluding Q1 2025. Despite occasional quarterly setbacks, year-over-year measures consistently reflected rising sales, contracting inventory, and steady appreciation in home values. Underpinning these market fundamentals were ongoing population gains, elevated construction activity, and stable – but comparatively higher – levels of mortgage arrears and unemployment relative to some other provinces.

Sales

Source: Edge Realty Analytics

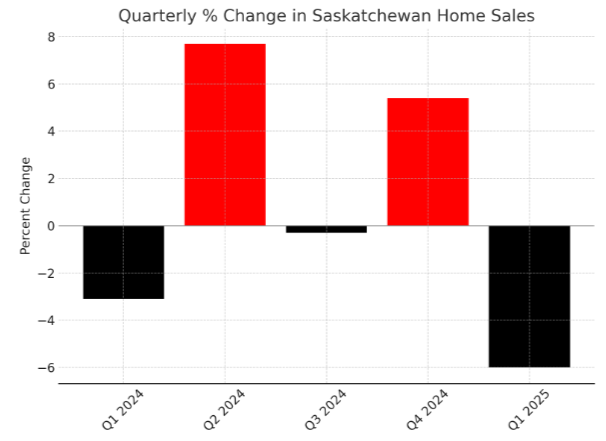

In the opening quarter of 2024, Saskatchewan recorded a modest 3.1% decline in home sales from the previous quarter, but year-over-year transactions were up 7.7%, showing potentially resilient buyer interest. The momentum accelerated in Q2, with sales rebounding 7.7% quarter-over-quarter and surging 12.5% above Q2 2023 levels. During Q3, activity dipped marginally by 0.3% from Q2 but maintained a robust 7.9% gain compared to the same quarter in 2023. Strong sales continued into Q4, rising 5.4% q/q and 11.8% y/y. Early 2025 saw a 6.0% quarterly contraction, but transactions remained 5.7% above Q1 2024, showing sustained demand despite the seasonal slowdown.

Listings

Source: Edge Realty Analytics

Source: Edge Realty Analytics

The supply side tightened notably throughout the period. In Q1 2024 new listings fell by 5.3% from Q4 2023 but were 9.7% higher than in Q1 2023; active listings contracted sharply, down 14.6% q/q and 5.8% y/y. By Q2, new listings inched up 0.7% q/q but retreated 4.4% y/y, while active inventory plunged 8.4% quarter-over-quarter and 19.6% year-over-year. The third quarter saw a 5.0% q/q rise in new offerings, yet active listings remained 2.7% lower than Q2 and 16.7% lower than Q3 2023. During Q4 2024, new listings declined 3.5% q/q and 4.1% y/y; active stock fell another 11.5% from Q3 and was 24.4% below Q4 2023. In Q1 2025 new listings receded 4.6% q/q and 4.0% y/y, while active supply shrank 8.2% from Q4 and 25.1% year-over-year, leaving the market at historically low levels of available homes.

Two metrics illustrate the shift toward seller-favourable conditions. Months of inventory steadily declined from 4.41 months in Q1 2024 to just 3.15 months by Q1 2025, indicating a tighter market throughout. Meanwhile, the sales-to-new listings ratio climbed from 61.9% in Q1 2024 to a peak of 74.3% in Q4 2024 before settling at 73.8% in Q1 2025. Ratios consistently above 60% confirm that listings were absorbed rapidly, sustaining seller leverage across all five quarters.

Prices

Source: Edge Realty Analytics

House values in Saskatchewan advanced each quarter, reflecting the imbalance between demand and diminishing inventory. The quarterly pace of the MLS Home Price Index (HPI) ranged from a 1.1% gain in Q2 and Q4 to a 1.9% uptick in Q3. On an annual basis, price growth accelerated steadily, from a 3.9% year-over-year increase in Q1 2024 to 4.5% in Q2, 5.7% in Q3, and 6.8% in Q4.

Q1 2025 sustained this trajectory with a 1.6% quarterly rise and 6.2% appreciation compared to Q1 2024.

Construction

Homebuilding gained traction across most quarters. After a 3.6% drop in dwellings under construction in Q1 2024 compared to Q4 2023, activity resumed growth, rising 0.8% q/q in Q2 and surging 15.1% in Q3. Year-over-year increases were especially pronounced in the latter half of 2024, with construction up 21.7% in Q3 and 16.8% in Q4.

In Q1 2025, the pipeline expanded another 1.9% from Q4 and leapt 23.5% above Q1 2024 levels. This expansion of supply facilities could help to ease market tightness over the medium term, even as immediate conditions remain competitive.