Between the first quarter of 2024 and the same period in 2025, Atlantic Canada’s housing market faced fluctuating sales and evolving supply conditions. A significant upswing in late 2024 gave way to more tempered activity in early 2025, while growth in construction may play a role in future market activity.

Sales

Source: Edge Realty Analytics

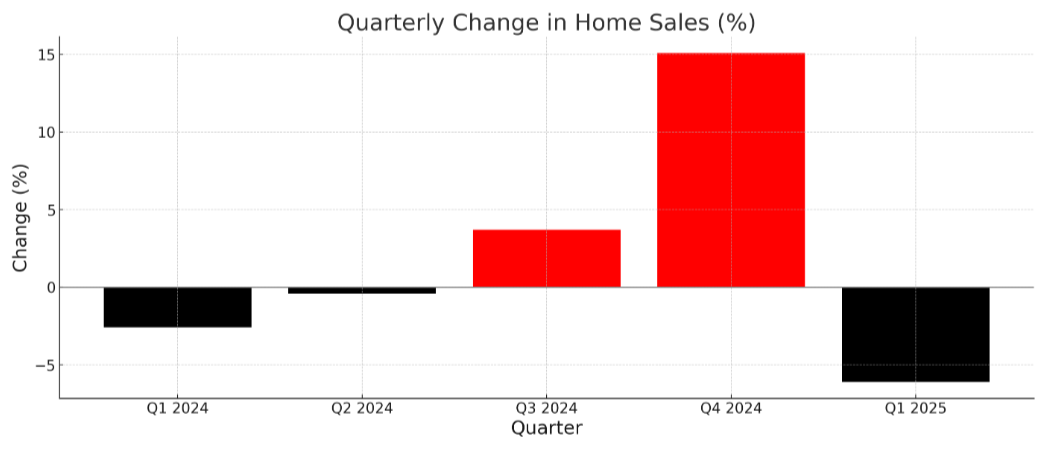

Sales in Atlantic Canada varied notably across the five quarters, with quarter-to-quarter shifts underscoring market volatility. Q1 2024 began with a -2.6% dip in home sales from the previous quarter, despite a +6.6% year-over-year gain. Sales remained relatively flat in Q2 (-0.4% q/q) before recovering in Q3 (+3.7%) and surging +15.1% in Q4, for the strongest gain of the period before another -6.1% dip in Q1 2025.

Listings and Inventory

Source: Edge Realty Analytics

Source: Edge Realty Analytics

New listings followed an upward trajectory overall, climbing from Q2 2024 onward. Active listings showed more mixed movement: despite moderate year-over-year growth through Q3, inventory tightened sharply in Q4 2024 (-7.7% q/q), reflecting strong seasonal demand. However, Q1 2025 brought a pause to this contraction, with active listings increasing slightly (+0.1%).

Q4 2024 represented the tightest conditions, with a sales-to-new listings ratio of 70.9% and months of inventory falling to 4.0. By Q1 2025, the ratio eased to 64.2% and months of inventory rose to 4.7.

Construction

Source: Edge Realty Analytics

One of the most consistent trends across the year was sustained growth in construction. Each of the first three quarters of 2024 saw significant quarter-over-quarter increases in dwellings under construction (+5.4% in Q1, +7.6% in Q2, +1.8% in Q3), as builders responded to continued population growth and affordability-driven demand. Although construction slowed slightly in Q4, activity rebounded again in Q1 2025, pushing year-over-year construction growth to +14.4% in early 2025.