Canadian housing starts exhibited a divergent pattern in March 2025, with many smaller centres outperforming the country’s largest metropolitan markets. While national starts declined 14% year-over-year, several mid-sized and smaller urban areas recorded substantial gains, according to data on housing starts from the Canada Mortgage and Housing Corporation (CMHC).

Major Metropolitan Markets Under Pressure

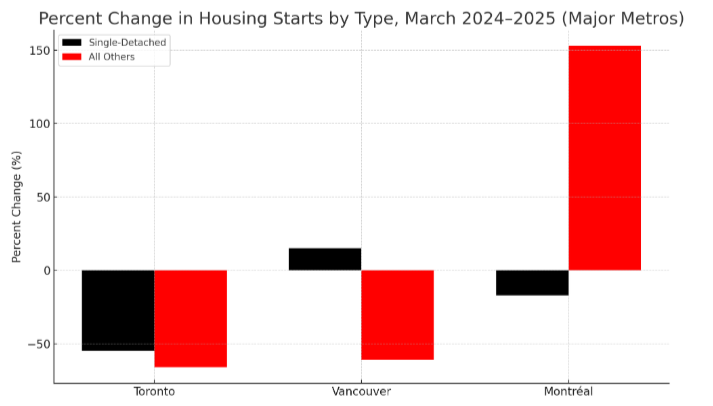

Toronto and Vancouver, which together account for a sizeable share of national starts, experienced steep downturns. Toronto’s total starts plunged 65%, driven by a 55% drop in single-detached units and a 66% reduction among all other types. Vancouver saw new starts fall 59% overall, as high-density product plunged 61% despite a modest 15% uptick in single-detached construction. Montréal bucked this trend to some degree, posting a 138% increase in total starts—anchored by a 153% surge in multi-unit projects—though its single-detached segment eased back by 17%.

Resilience in Prairie Regions

Several prairie and mountain-region cities recorded robust growth. Saskatoon’s total starts more than tripled (+273%), with multi-unit construction soaring 382% and single-detached homes up 86%. Winnipeg also showed strong momentum, registering a 75% increase in total starts driven by a near-doubling (+94%) of multi-unit projects. Edmonton’s market expanded 21% overall, largely on the back of a 68% jump in single-detached homes, even as apartments and townhomes edged down 1%.

Rapid Expansion in Smaller Centres

Beyond the largest centres, noteworthy booms occurred in communities like Brantford and Trois-Rivières, where total starts rose 420% and 229% respectively. Brantford’s growth stemmed entirely from a surge in multi-unit construction—from zero starts a year earlier to 69—while Trois-Rivières saw single-detached starts climb 433%. Lethbridge and St. John’s also recorded triple-digit increases in total new construction (+264% and +150%, respectively), reflecting both single-family and multi-unit expansions.

Overall, Canadian housing construction in major centres appears to be scaling back, while smaller and mid-sized centres pick up the slack, leading to divergent regional performances.