I hope you had time to relax and recharge over the holiday season.

I will be back to my regular Monday Morning Updates next week, and in the meantime, here are links to five recent posts to get you caught up:

- These are my most important observations about our current interest rate environment as we head into 2023.

- Here is my take on whether the Bank of Canada’s policy rate has finally peaked.

- This post explains how trigger rates work for Canadian variable-rate mortgages, which come with fixed payments (and it also assuages fears that trigger-rate resets will soon lead to a US-style housing-market meltdown).

- Here is my take on why inflation may take longer to come down than the consensus expects.

- This post offers my detailed breakdown of the US Federal Reserve’s last jumbo-sized rate hike.

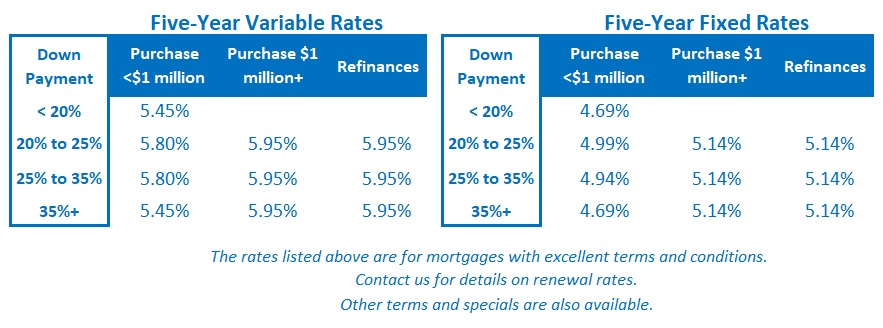

The Bottom Line: Government of Canada bond yields have surged higher over the holiday break, and there is less air under our fixed rates as a result. Given that, the momentum arrow for fixed rates is pointing up over the near term.

The Bottom Line: Government of Canada bond yields have surged higher over the holiday break, and there is less air under our fixed rates as a result. Given that, the momentum arrow for fixed rates is pointing up over the near term.

Variable-rate borrowers may be in for another 0.25% rate hike by the Bank of Canada at its next meeting on Jan 25, but that will likely mark their peak for the current cycle.