The recent movements in Government of Canada (GoC) bond yields and, by association, our fixed mortgage rates, have been primarily determined by US President Donald Trump’s erratic tariff-policy announcements.

Canadian bond-market investors are trying to price in how tariffs will affect both inflation and our economy’s overall trajectory. To do that, they must make assumptions about where those tariffs will level out, and how long they will last.

The state of the US economy helps to inform those assumptions.

If the US economy slows sharply, that will increase the pressure on President Trump to quickly reduce his tariffs to more reasonable levels, and will thereby reduce their negative impacts on our economy.

Conversely, if the US economy is less significantly impacted by the tariffs, that will give him more latitude to sustain the tariffs at higher levels. In that scenario, the negative impacts on our economy will be more severe and longer lasting.

With that in mind, let’s examine two key pieces of US economic data, which were released last week.

The US GDP Data for Q1, 2025

On Wednesday, we learned that US GDP decreased by 0.3% on an annualized basis in Q1, marking the US economy’s first contraction in three years.

Most of the decline was attributed in large part to a spike in imports as US businesses built up their inventories in advance of Trump’s tariff deadline. (Imports are a subtraction in the GDP calculation.)

There were other signs of demand being brought forward. Final sales of goods to domestic purchasers increased by 3% in Q1 (annualized), up from 2.9% in the previous quarter. Increased demand now will likely translate into reduced demand, and lower GDP, later.

President Trump has been talking about tariffs since his campaign, but his “Liberation Day” announcement only took place on April 2. As such, the Q1 GDP data only reflects how the US economy responded in anticipation of the tariffs.

The impacts from the tariffs themselves, which were set at much higher levels than most market watchers expected, will become increasingly evident in the ensuing quarters.

The Latest US Non-Farm Payroll Report (for April)

On Friday we learned that the US economy added 177,000 new jobs in April, above the consensus forecast of 135,000. The unemployment rate held steady at 4.2%, as did average wage growth, which continued to increase at 3.8% on an annualized basis.

While the latest employment report was considered strong overall, that assessment came with some important caveats.

The employment data were compiled in the middle of April, only two weeks after Trump’s tariff announcement. Just as with the US GDP data, the negative impacts from tariffs will become increasingly evident in the months that follow.

Additionally, because the US employment data are difficult to track in real time, the non-farm payroll data include many statistical plugs that are based on historical trends.

In stable conditions, those plugs help to smooth out short-term anomalies that ultimately prove to be just “noise”. But at turning points in the economic cycle, those same plugs muffle the employment data’s power to signal when a material change is occurring.

Over time however, revisions are made, and the signal becomes clearer. To wit, the latest US payroll report included a downward revision of 58,000 jobs to its original estimates for February and March.

The latest US GDP and employment reports have provided only fleeting signs of a US economic slowdown thus far. But soft data, such as business and consumer surveys, have confirmed a surge in negative sentiment, and that is typically a warning that the hard data will weaken soon.

Mortgage Advice for Now

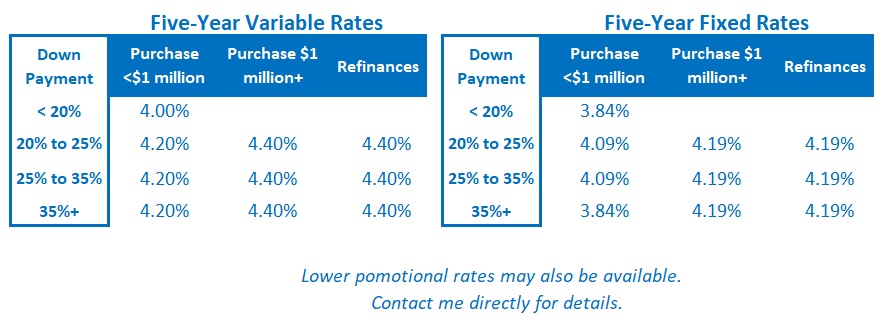

Last week’s post provided a detailed breakdown of the mortgage-rate advice I am offering to the borrowers I am currently working with.

If you are interested in a more technical comparison of pros and cons of fixed versus variable-rate options, you can find that here.

The Bottom Line: The GoC bond yields, which our fixed mortgage rates are priced on, had another volatile week.

They were first pulled lower by their US Treasury equivalents on Wednesday when the US GDP data came in a little lower than expected before being pulled higher by the stronger-than-expected US employment data released on Friday.

All told, GoC bond yields finished the week a little lower, but not enough to portend an imminent change in our fixed mortgage rates.

Increased economic uncertainty has caused credit spreads to widen, of late. That has increased lender funding costs, and they have responded by reducing their variable-rate discounts. But they held steady last week.

I continue to expect the Bank of Canada to enact more policy-rate cuts in 2025.

Right now, the Bank’s policy rate stands at 2.75%. I think it will bottom out at 2%, or lower, before the year is out. If I’m right, our variable mortgage rates will drop by the same amount.