Manitoba’s housing sector demonstrated resilience in March 2025. Manitoba’s residential real estate market demonstrated sturdy performance in the first quarter, balancing record-high price levels with rising sales activity.

While new listings showed year-over-year growth, overall supply metrics remain below historical averages, resulting in lower months of inventory. At the same time, rental rates continued to climb modestly.

Sales

Source: Manitoba Real Estate Association

For the month of March 2025, according to the Manitoba Real Estate Association, MLS® home sales showed a 5.3% year-over-year increase compared to March 2024. Sales remained slightly below historical norms, at 11.6% under the five-year average and 1.5% under the ten-year average for the same month. When viewed on a year-to-date basis, sales activity in the first quarter of 2025 climbed by 6.4% compared to the same period in 2024.

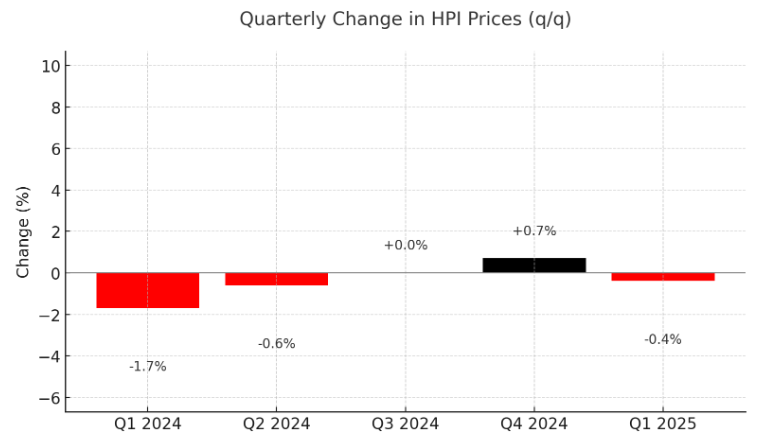

Prices

Source: Manitoba Real Estate Association

Average home prices in Manitoba edged upward to unprecedented levels in March 2025. The benchmark for the month stood at $399,132, a 10.1% increase from $362,398 in March 2024. Over the first three months of the year, the more comprehensive year-to-date average price rose by 8% to $381,577, compared to $353,306 in the same span of 2024.

Listings and Inventory

Source: Manitoba Real Estate Association

New residential listings in March 2025 totalled 1,985 units, representing an 8.3% increase from March 2024. Despite this year-over-year rise, new listings remained 3.4% below the five-year monthly average and 7.9% below the ten-year average.

Meanwhile, active listings at the end of March fell sharply to 2,653 units, a 15.4% decrease from the 3,135 units available at the end of March 2024. Active listings were also below both the five-year (4.6%) and ten-year (26.1%) averages for this time of year, showing tighter overall supply conditions. Consequently, the months of inventory metric, calculated by dividing active listings by the average monthly sales rate, dipped to 2.1 months at the end of March 2025, down from 2.6 months a year earlier, and below the long-run average of about three months.

Rental Market Snapshot

Source: Rentals.ca