No new post this week (I was away on vacation this past weekend).

I’ll be back next Monday with an update on Canadian mortgage rates. In the meantime, here are a few links to some of my most popular recent posts:

This post explains why I think the bond market’s new bets on Bank of Canada (BoC) rate hikes later this year are likely too aggressive.

This post explained why I thought the bond market’s bets on rate cuts starting as early as this fall were too optimistic. (Those bets ended up being unwound shortly after this post was written.)

This post explains how the US Federal Reserve’s indication that it will likely pause from making additional rate hikes over the near term will impact our mortgage rates.

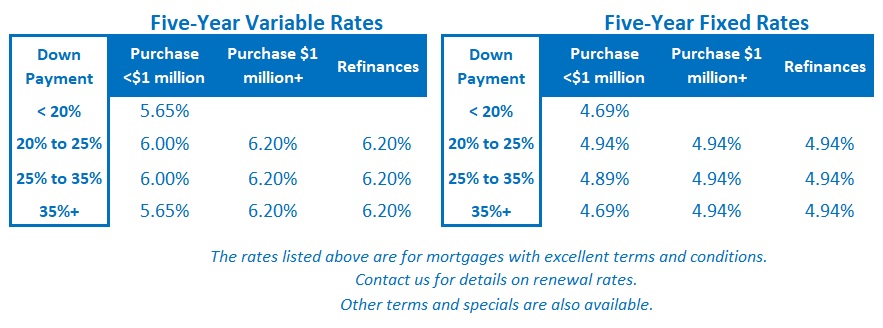

In this post I offer my take on whether Canadians should be considering variable-rate mortgage options now that our economic momentum is slowing and inflation has fallen steadily from its peak. The Bottom Line: Government of Canada bond yields continued to rise last week, and borrowers should expect lenders to continue raising their fixed rates over the near term.

The Bottom Line: Government of Canada bond yields continued to rise last week, and borrowers should expect lenders to continue raising their fixed rates over the near term.

Anyone who is considering fixed-rate options over the near term is well advised to lock in a pre-approved rate as soon as possible.

Variable-rate discounts were unchanged last week.

I expect the BoC to start cutting its policy rate when it next moves off the sidelines, but I continue to believe that won’t be until some time in 2024.