March 2025 marked an upswing for the Northern BC residential real estate market. The first quarter of 2025 showed sales volumes reverting towards long-term averages and prices rising. Geographical variances, from rapid sales growth in Fort St. John to price premiums in Smithers, highlight the impacts of local dynamics within the broader regional context.

Sales

In March, the total residential sales saw an 18% increase compared to March 2024, though volumes still remained 12.5% below the five-year March average and 3.1% below the ten-year March average, according to the BC Northern Real Estate Board (BCNREB).

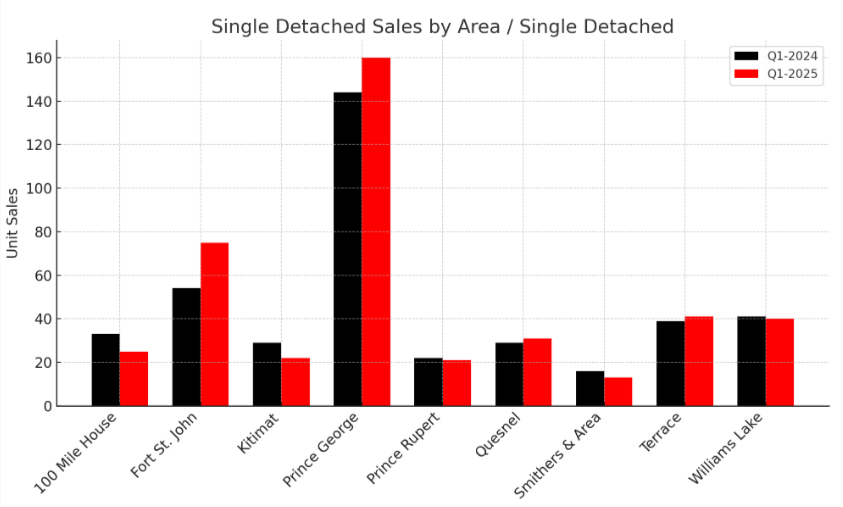

On a year-to-date basis, sales through the first quarter were up 10.4% from the same period in 2024. Single detached homes accounted for the bulk of this activity, with a 4.5% increase in Q1 2025 over the first quarter of 2024. As Victor Khong, Chair of the BCNREB, observes, “The momentum in activity has been carrying forward for about two years now and shows no signs of stopping,” driven by steady new listings and balanced inventory levels.

Price

The average price of homes sold in March rose to $437,118, a 4.3% increase from March 2024. Looking at the first three months of the year, the more comprehensive year-to-date average price stood at $414,417, up 2.6% from Q1 2024. It is important to note, however, that these average prices do encompass a wide range of property types across a large area. However, modest price appreciation and rising sales were seen, providing a general trend.

Inventory

New residential listings in March were 5.6% higher than in March 2024, although they still sat 1% below the five-year March average and 4.1% above the ten-year average. Active listings at month-end were 2.7% lower than March 2024 but 7.8% above the five-year norm.

Crucially, months of inventory, a measure of how long it would take to exhaust existing listings at the current sales pace, fell to 4.7 months, down from 5.7 months a year earlier and below the long-run average of 5.5 months.

Regional Variations

Within the single-detached market, each community showed its own pattern of change. Fort St. John topped the list for sales growth, with a rise of 38.9% in Q1 2025 over the same period in 2024. Its median price also climbed, reaching $416,000, up 7.1% over Q1 2024.

Prince George saw a more modest increase in activity. Sales rose by 11.1%; however, the median price dipped slightly to $475,000, down 2.4%.

Smaller centres produced mixed results. Quesnel’s sales were up 6.9%, and its median price held steady at about $340,000. In Kitimat and 100 Mile House, unit sales fell by roughly 24%, but each posted a 7.3% gain in median price.

Smithers & Area stood out for its price gains, with the median jumping 38.9% to $660,000 even though sales slipped by 18.8%.