Canada’s purpose-built rental market showed signs of renewed momentum in March 2025, reversing a multi-month downward trend with a modest monthly increase in asking rents. While year-over-year figures remain slightly negative, purpose-built units are demonstrating greater stability and long-term growth compared to their condominium rental counterparts.

According to data from Rental.ca’s April 2025 Rent Report, average asking rents across all residential property types rose by 1.5% month‑over‑month to $2,119 in March. This marks the first monthly increase since September 2024, as markets emerged from the seasonal winter slowdown and leasing activity picked up in advance of spring. Despite this rebound, rents remained 1.5% lower than they were a year ago, reflecting the impact of elevated new supply and affordability pressures that have persisted over recent quarters.

Source: Rentals.ca

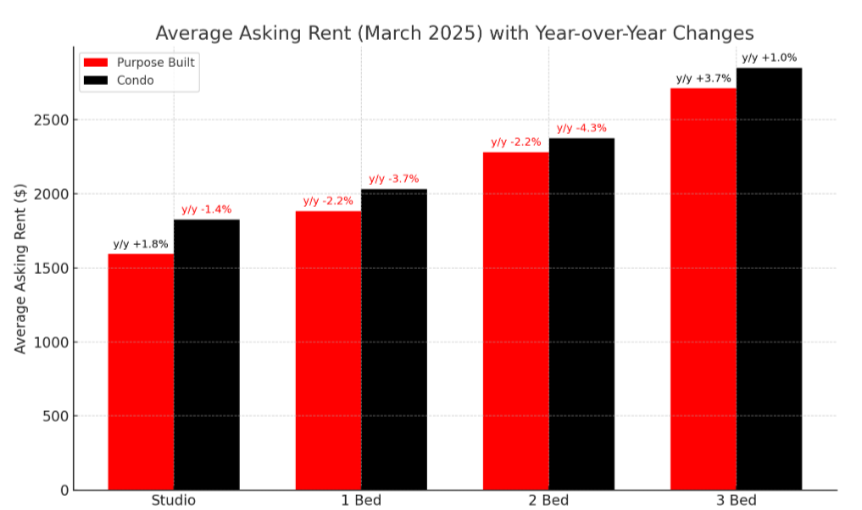

Within the purpose-built segment,three-bedroom apartments saw the largest year‑over‑year (y/y) increase, rising by 3.7% to $2,711. Studio units also posted y/y gains, up 1.8% to $1,593. On the other hand, one- and two-bedroom purpose-built units saw annual declines of 2.2%, averaging $1,883 and $2,280, respectively. These remain the most common unit types and are therefore more sensitive to supply-side dynamics.

While purpose-built rentals showed some signs of stabilization, the condominium rental market continued to experience mounting pressure. Average asking rents for condominium apartments fell by 3.8% year-over-year in March to $2,232. Two-bedroom condo rents dropped 4.3% to $2,374, while one-bedroom units declined by 3.7% to $2,032.

Unlike purpose-built buildings, which are typically managed by institutional landlords or professional property managers, condo rentals depend heavily on individual investor decisions. This can create more volatility, particularly in cities where a large share of new housing supply has come from condo construction. Additionally, purpose-built buildings may be more likely to include on-site services, longer-term tenancy options, and more predictable rent structures, which appeal to potential tenants.

Despite recent fluctuations, purpose-built rental rates remain significantly higher than pre-pandemic levels. Since March 2020, average asking rents for purpose-built apartments have increased by 35.5%, with three-bedroom units up 39.6% and two-bedroom units up 38.4%. These gains exceed those seen in the condo segment, where rents have risen just 0.6% over the same period.