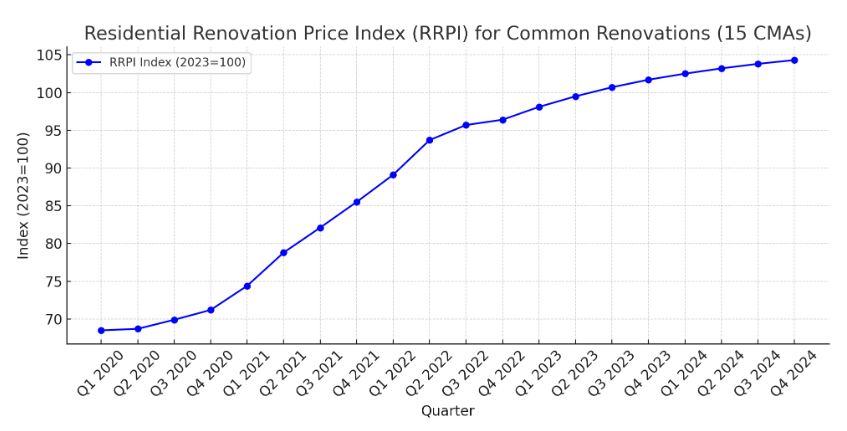

The Residential Renovation Price Index (RRPI) tracks changes in the costs of common home renovation projects over time. It offers insight into how fluctuations in material and labour costs may affect your overall renovation budget. For homeowners and real estate investors, this index is a key indicator, highlighting market trends and helping them to budget for increases.

Released on April 2, 2025, the fourth quarter report of Stats Canada’s Residential Renovation Price Index (RRPI) shows the slowest quarterly growth since mid-2020, with a national increase of 0.5%. However, going forward in 2025, evolving trade conditions, including shifts in global supply chains, tariff adjustments, and changing demand, are playing a significant role in driving up the costs of key materials and labour. As these factors continue to influence the RRPI, homeowners and investors should monitor these trends closely when planning their renovation projects.

In previous periods, residential renovation prices exhibited slightly stronger rises. However, those earlier periods also reflected distinct regional dynamics and project-specific trends.

National and Regional Trends

The latest quarter has seen an overall deceleration in price growth, but regional disparities persist. In the fourth quarter, Alberta and Saskatchewan led with increases of 1.2% and 1.1% respectively. This stands in contrast to earlier trends: the third quarter of 2024 featured Quebec as a significant contributor with a 0.9% rise, while the second quarter saw the West Coast, particularly British Columbia, recording a 1.4% increase.

Across the 15 census metropolitan areas (CMAs) tracked by the RRPI, Regina now tops the list with a 1.8% increase. Earlier data from the third quarter highlighted growth in Montréal and Ottawa, where renovation prices surged more noticeably than in other areas. Meanwhile, in the second quarter, urban centers like Victoria and Vancouver experienced robust gains, driven by high demand on the West Coast.

Project-Specific Cost Drivers

The evolution of cost pressures is also evident in the types of projects impacted. In the third quarter, the roofing, windows, and doors groups were at the forefront of price increases. However, in the fourth quarter, projects involving substantial concrete and stonework, as well as those focused on solar panels and fireplaces, experienced the most significant price hikes.