Last week the US Federal Reserve left its policy rate unchanged for the third time in a row, and we learned that the Canadian economy shed jobs in April.

Today’s post offers my take on how these important updates are likely to impact Canadian mortgage rates.

The Fed’s Latest Rate Decision

The Fed’s dual mandate requires it to use monetary policy to achieve the highest level of employment the economy can sustain while also maintaining stable prices.

Right now, the US unemployment rate is 4.2%, which is relatively low, and the US Consumer Price Index (CPI) slowed from 2.8% in February to 2.3% in March on an annualized basis, marking its lowest level since last September.

Against that backdrop there is no immediate urgency for the Fed to cut, but it is nonetheless concerned about the negative impacts of US President Trump’s tariffs, which are intensifying.

Both the actual tariffs already in effect and the threat of more substantial future tariffs are weighing on US businesses and consumers alike and causing the Fed to expect the US economy to slow further.

According to its most recent projection, the Fed expects to cut its policy rate by a total of 0.50% over the remainder of the year. US bond-market investors are more dovish. They are pricing in a total Fed reduction of 0.75% in 2025.

The Fed’s decision to continue to stand pat would normally have negative implications for Canadian mortgage rates.

The gap between the Bank of Canada (BoC) and Fed policy rates is particularly wide right now. That causes the Loonie to weaken against the Greenback.

A weaker Loonie fuels inflation because it raises the cost of everything we import. More inflation puts upward pressure on Government of Canada (GoC) bond yields, which our fixed mortgage rates are priced on, and it makes the BoC less likely to reduce its policy rate, which our variable mortgage rates are priced on.

But the Loonie hasn’t weakened against the Greenback to the extent that most market watchers expected.

In fact, it has appreciated against the Greenback since President Trump was inaugurated because his policies have reduced the appetite of foreign investors for US assets. More broadly, some would argue that his overall unpredictability has also undermined faith in the Greenback as the world’s ultimate safe-haven asset.

The silver lining is that the Loonie’s recent strength has helped to reduce the upward pressure on our mortgage rates that the wide gap between the BoC and Fed policy rates would otherwise be engendering.

Canadian Employment Data Starting to Show Tariff Impacts

Last Friday Statistics Canada confirmed that our economy added 7,400 new jobs in April. But that positive headline belied plenty of weakness in the underlying data.

For example, last month’s overall gain was helped by temporary election-related hiring. Without that bump, our economy would have shed 30,000 jobs in April.

Last month’s slightly positive headline also didn’t prevent our unemployment rate rising for the third consecutive month because our population growth continues to outpace our economy’s rate of job creation.

Our unemployment rate is now 6.9%, matching its highest level in eight years, and there are 1.55 million working-aged Canadians who are now unemployed, the most in nearly fifteen years.

Last month’s hardest hit sectors were those most impacted by trade uncertainty. Our economy lost 31,000 manufacturing jobs, with Ontario’s automotive sector the hardest hit, and our wholesale and retail trade sector also shed 27,000 jobs.

Bond-market investors responded to our weak employment report by increasing the odds of a BoC rate cut at its next meeting on June 4 from 50% earlier in the week to 60% by the close of business on Friday.

Mortgage Advice for Now

This recent post provides a detailed breakdown of the general mortgage-rate advice I am offering to the borrowers I am currently working with.

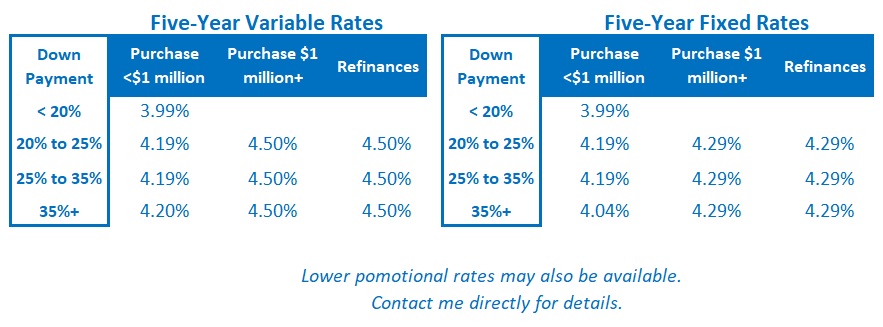

If you are interested in a more technical comparison of the pros and cons of fixed versus variable-rate options, you can find that here. The Bottom Line: GoC bond yields were range bound last week, but that didn’t stop some lenders from increasing their fixed-rate offerings.

The Bottom Line: GoC bond yields were range bound last week, but that didn’t stop some lenders from increasing their fixed-rate offerings.

Where fixed rates go next will likely be determined by the release of the latest US CPI report for April on Tuesday.

Variable-rate discounts were unchanged.

Last week’s employment report increased the odds of a BoC rate cut at its next meeting on June 4. The Loonie’s surprising strength against the Greenback will help mitigate the BoC’s concern about continuing to reduce its policy rate while the Fed stands pat.