I hope that you enjoyed the Family Day long weekend.

I used the holiday yesterday for its stated purpose, so there won’t be a new post this week. I’ll be back next Monday as usual.

In the meantime, here are links to five of my recent posts about Canadian mortgage rates and inflation:

- Canadian Hiring Surge Undermines Rate-Cut Bets

- Was the US Federal Reserve’s Most Recent Hike Really That Dovish?

- Why We Shouldn’t Over-React to the Bank of Canada’s Rate-Hike Pause

- Why Softer US Inflation Doesn’t Change My View on Mortgage Rates

- Mortgage-Rate Forecast and Predictions for 2023

The Bottom Line: Stronger-than-expected economic data have the bond market giving more credence to the warnings from both the Bank of Canada (BoC) and US Federal Reserve that rates will likely need to remain at or above today’s level for a considerable period.

The Bottom Line: Stronger-than-expected economic data have the bond market giving more credence to the warnings from both the Bank of Canada (BoC) and US Federal Reserve that rates will likely need to remain at or above today’s level for a considerable period.

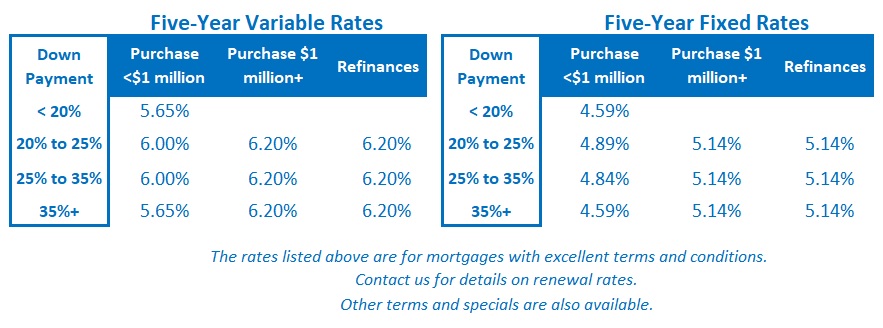

Government of Canada bond yields continued to surge higher last week, and another round of increases to our fixed mortgage rates is already underway.

Variable-rate discounts were unchanged, but variable-rate borrowers should note that the bond futures market has now priced out the two quarter-point rate cuts that were expected by the end of 2023. It is now pricing in one more quarter-point BoC increase before the year is out.