I will be taking a short break from blogging for the next two weeks.

I’ll be back at it on Monday, June 2 to offer my take on the Bank of Canada’s (BoC) next policy-rate decision on June 4.

In the meantime, here are links to five of my most popular recent blog posts:

This post offers a detailed (and technical) breakdown of the pros and cons of fixed- and variable-rate mortgages amidst our current trade war.

This post provides a summary of the general mortgage-selection advice I am offering right now. It also compares fixed- and variable-rate options, but with more focus on where I think rates may be headed in future.

This post offers my take on the BoC’s decision not to cut its policy rate at its last meeting on April 16.

This post explained why I thought the BoC would cut at its April 16 meeting. While my prediction proved incorrect, the factors that underpinned my rationale are still largely present and explain why I believe that more cuts are still in store.

This post focuses on how the US Federal Reserve’s latest rate decision (on May 7) and our weakening employment data (released on May 9) are likely to impact Canadian mortgage rates. The Bottom Line: It was another volatile week for bond yields. They surged higher on Monday in response to the US/China tariff walk-back but then declined back down to finish the week about where they started it.

The Bottom Line: It was another volatile week for bond yields. They surged higher on Monday in response to the US/China tariff walk-back but then declined back down to finish the week about where they started it.

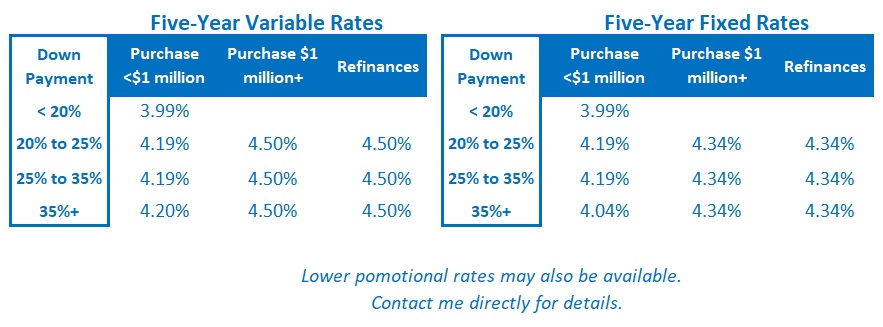

Some lenders increased their fixed rates by a little, but just as with bond yields, they remain mostly range bound.

Variable-rate discounts were unchanged last week.

Bond-market investors are currently pricing in a 50% chance of a BoC rate cut at its next meeting on June 4.