The Bank of Canada (BoC) held its policy rate steady last week as the consensus expected it would.

For my part, I think the Bank will regret its decision not to cut and will be compelled to reduce its policy rate by more, in totality, as a consequence.

Before I explain why I write that, let me start by acknowledging how difficult the BoC’s job is.

Setting monetary policy is tough on a good day, because it can take more than a year for policy rate changes to exert their full impact. In the meantime, myriad forces are influencing our economy’s direction.

When the on/off nature of US President Trump’s extraordinary tariff announcements is added into the mix, the BoC’s ability to accurately determine the correct policy path forward is further complicated.

Despite all that, I still think there was a compelling case for another cut.

The Bank assessed that our economic growth in Q1 came in “slightly stronger than expected”, but only because businesses on both sides of the 49th parallel loaded up their inventories ahead of tariff deadlines.

Any growth tied to rising inventories is just demand borrowed from the future. For that reason, the BoC quite rightly expects our economic momentum to be “considerably weaker in the second quarter”.

The Bank noted that our “labour market has weakened”, and it observed “a large drop in consumer confidence”. Not surprisingly, “housing activity was down, driven by a sharp contraction in resales”. Government spending also declined.

Absent the short-term sugar high of a tariff-related inventory build-up, I don’t see any positive catalysts for our economy right now.

The headwinds are much more readily apparent, including one that hasn’t received much mention to this point.

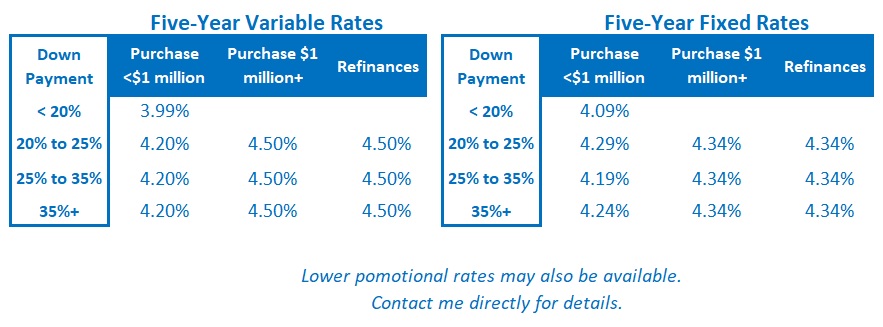

The BoC’s decision to stand pat means that our variable mortgage rates were unchanged. But Government of Canada (GoC) bond yields have been pulled higher by their US Treasury equivalents, and that has increased our fixed mortgage rates (which are priced on them).

Higher fixed rates reduce demand in our economy in many of the same ways that BoC rate hikes do, which means our overall financial conditions are tightening even as the Bank stands pat.

The US tariff headwind also continues to intensify.

While the BoC was issuing its latest policy statement last Wednesday, President Trump was announcing that he will raise US steel and aluminum tariffs from 25% to 50%. This tariff hike will have a disproportionately negative impact on the Canadian economy relative to the rest of the world because the US imports 60% of its aluminum from Canada, and 23% of its steel.

With all signs pointing toward an economic slowdown and, with the BoC acknowledging as much, why didn’t it cut?

The short answer: inflation.

The Bank is concerned about “some unexpected firmness in [our] recent inflation data”.

To wit, its “preferred measures of core inflation, as well as other measures of underlying inflation, moved up”. At the same time, “households continue to expect that tariffs will raise prices, and many businesses say they intend to pass on the costs of higher tariffs.”

The BoC hasn’t forgotten that it let the inflation genie out of the lamp at the end of COVID when our Consumer Price Index (CPI) soared to 8.1%. Once bitten, twice shy.

But is that concern fully warranted?

The circumstances between now and then are markedly different.

When COVID ended, there was a ton of pent-up demand, consumers had huge amounts of excess savings, and they were confident in their job prospects. Those factors greatly reduced their sensitivity to price increases. That opened the door wide for businesses to increase their prices whether they needed to or not. Many of them took advantage.

Our current backdrop stands in stark contrast.

Consumers are stretched. Debt utilization is high and increasing, as are delinquency rates. Consumers expect tariffs to cause price rises, and a wide swath of them plan to cut back on their discretionary spending to make ends meet. Wage growth is cooling, job prospects are deteriorating, and our unemployment rate has now reached 7%.

For their part, Canadian businesses expect to increase their prices because of our federal government’s counter tariffs on US imports. But given the weaker consumer backdrop, those increases are much more likely to impact sales volumes this time around.

There is an old rule of thumb that one-third of tariff costs are absorbed by suppliers, one-third are taken out of the seller’s profits, and the final one-third are then passed on to consumers.

If that ratio holds roughly true this time, only a portion of the tariff-related costs will be passed on to consumers. Even then, an increasing number of them will be hard pressed to absorb those increases.

That backdrop is hardly inflationary.

I understand why the BoC is reluctant to risk its inflation credentials when there is so much uncertainty surrounding tariffs. But we’re in a serious trade war. The BoC still needs to skate where the puck is going.

Our economy is headed for a sharp slowdown, and the Bank shouldn’t be waiting for the data to bear that out.

We need a stimulative monetary policy rate of 2% (or lower) to help offset that coming weakness. The longer it takes the BoC to get there, the greater the impact today’s negative economic headwinds will ultimately have. The Bottom Line: GoC bond yields were pulled higher by their US Treasury equivalents last week as bond-market investors balked at the inflationary impact of President Trump’s “Big, Beautiful Budget Bill”.

The Bottom Line: GoC bond yields were pulled higher by their US Treasury equivalents last week as bond-market investors balked at the inflationary impact of President Trump’s “Big, Beautiful Budget Bill”.

We will receive the latest US CPI data, for April, this week. I think the related short-term risks to our bond yields and our mortgage rates are one-sided.

If US inflation is cooler than expected, I think bond-market investors will dismiss the data as old news. But if there is even a hint that US prices are heating up, I expect investors to push bond yields higher as their fears of rising US inflation are confirmed.

Although the BoC didn’t cut last week, I think it is still reasonable for variable-rate borrowers to expect further reductions.

The bond futures market is currently pricing in two more 0.25% cuts. For my part, I still think we’ll see three (or perhaps even more) before the current rate-cut cycle ends.

The timing of the cuts will also matter. The longer the BoC waits to reduce its policy rate to a stimulative level, the more stimulus it will ultimately need to provide.